So we've put together a list of the top financial planners and advisors in Melbourne, Victoria. Our list includes some of the most trusted names in the industry, so you can rest assured that you're in good hands. Whether you're looking for help with your retirement planning or you need advice on investment options, these advisors have got you covered. So what are you waiting for? Check out our list today!

Have you considered what will happen to your finances if you become ill or die? If not, now is the time to think about it. A financial planner can help you plan to ensure your family is taken care of after you're gone. Here are some tips on choosing the right planner for your needs.

Freedom Financial Planning

Freedom Financial Planning stands out for its mission to empower clients to take control of their financial futures. By providing knowledge, tools, and support, the firm helps clients make informed decisions about their money. This client-centric approach is reflected in the wide range of services offered, aimed at taking the pressure off clients so they can focus on building wealth and living their best lives. The firm's process is simple yet powerful, offering a financial roadmap with clearly defined goals and deadlines.

Services offered:

- Lending & Mortgage Solutions

- Aged Care Advice

- Superannuation Advice

- Retirement Advice

- Investment Property Loans

Phone: 03 9542 3200

Email: askus@freedomfp.com.au

Address: Suite 29, 270 Ferntree Gully Road, Notting Hill VIC 3168

Website: https://freedomfinancialplanning.com.au/

Klear Picture

Klear Picture in Melbourne offers unparalleled expertise in financial and wealth management services. Their team is committed to providing customised financial strategies that cater to the unique needs of each client, ensuring effective wealth building and management.

Services Offered:

- Accounting & Taxation: specialized services for individual and corporate clients.

- Business Advisory: Strategic business planning and financial advice.

- Private Wealth Advisory: Personalized wealth management and investment strategies.

- Lending & Capital Raising: Tailored finance solutions for various property types.

Address: 312/434 St. Kilda Road, VIC 3004

Phone: (03) 9998 1940

Email: team@klearpicture.com.au

Website: klearpicture.com.au

PMD Financial Advisers

At PMD Financial Advisers, the focus is on providing clients with a sense of certainty and reassurance about their present and prospective financial situations. The firm excels in serving a diverse array of clients, including families, individuals with substantial wealth, business executives, and entrepreneurs. They stand out for their personalised approach, emphasising the creation of strong, enduring client relationships and delivering customised financial advice that resonates with the individual financial aspirations and requirements of each client.

Services Offered by PMD Financial Advisers:

- Wealth Creation: Assistance in cultivating a substantial asset foundation.

- Retirement Planning: Crafting plans to realise retirement financial targets.

- Superannuation: Techniques for increasing superannuation fund balances.

- Investment Advisory: Expert insights on various investment opportunities.

- Risk Insurance: Protective measures for clients' financial well-being.

- Self-Managed Superannuation Funds: Expert advice on SMSF advantages.

- Aged Care Planning: Helping clients navigate aged care choices effectively.

- Financial Advice for Children: Strategic investment advice for family financial planning.

Phone: (03) 9824 0001

Email: admin@pmdadvice.com.au

Website: https://www.pmdadvice.com.au/

Empower Wealth

Empower Wealth offers comprehensive financial planning services in Melbourne, focusing on assisting clients in accumulating wealth. Their team of financial planners provides tailored advice on financial management, covering areas such as superannuation, both mainstream and Self Managed Super Funds (SMSFs), personal insurance, and various investment opportunities in shares, bonds, cash savings, managed funds, and indirect property. Empower Wealth's approach to retirement planning, especially in relation to SMSFs, is well-regarded for the flexibility it provides, including options like property investments within the fund. The firm is committed to helping clients understand the implications of establishing an SMSF, considering both the financial and time investment against the potential benefits like increased control and adaptability.

The services offered by Empower Wealth include:

- Superannuation Advice: Expertise in mainstream superannuation and SMSFs.

- Personal Insurances: Consultation on insurance options to safeguard clients and their assets.

- Investment Options: In-depth guidance on a range of investment platforms.

- Retirement Planning: Focused assistance on retirement planning, including SMSF setup and management.

Phone: 1300 123 842

Email: enquiries@empowerwealth.com.au

Website: https://empowerwealth.com.au/

DMFS Financial Advisers

At DMFS Financial Advisers, their specialty lies in financial and retirement planning, focusing particularly on re-contribution strategies related to superannuation benefits. Their technique centres on the withdrawal and re-investment of superannuation funds, categorising them into tax-free and taxable elements. This strategy is highly effective in reducing the potential tax liability for beneficiaries inheriting superannuation after the death of the original holder. Ideal for individuals who are between the preservation age of 56 and 60, this approach is also crucial for estate planning, especially when passing on superannuation benefits to non-dependents such as adult children. The strategy's main aim is to convert the taxable components of the superannuation into tax-free elements, thus minimising the tax burden on the beneficiaries.

Key services provided by DMFS Financial Advisers:

- Re-contribution Strategy: Techniques for optimal tax-free benefits in superannuation.

- Tax Optimization: Strategies to reduce tax implications on superannuation for heirs.

- Estate Planning: Customized superannuation planning to lessen tax impacts on non-dependant inheritors.

- Comprehensive Financial Planning Advice: In-depth guidance on various aspects of financial planning.

- Aged Care Financial Consultation: Specialized advice on financial planning for aged care needs.

Phone: 1300 364 650

Website: www.dmfsfinancial.com.au

Paterson Retirement Planning

Paterson Retirement Planning, led by Senior Financial Adviser Ed Paterson, specialises in simplifying the retirement financial planning process. Their core mission is to alleviate financial complexities in the lives of their clients, allowing them to focus on their priorities. With a deep understanding of the distinct financial opportunities and challenges encountered by individuals in the education and broader public sectors, Paterson Retirement Planning provides personalised advice for a customised retirement journey. Their approach is centred around the client, collaborating closely to create financial plans that align with their unique retirement vision, ensuring a seamless and stress-free transition.

The array of services offered by Paterson Retirement Planning includes:

- Superannuation: Expert guidance on fund selection and investment combinations to maximise retirement savings.

- Retirement Planning: Tailored strategies designed for a comfortable retirement, accommodating individual needs.

- Aged Care: Assistance with aged care planning and related financial considerations.

- Centrelink: Support in navigating Centrelink payments and entitlements.

- Insurance: Establishment of financial security to mitigate unforeseen health-related financial challenges.

- Business Protection: Financial support for both small and large businesses during uncertain times.

Phone: (03) 9630 099

Email: info@plantoretire.com.au

Website: https://www.plantoretire.com.au/

Kearney Group

Kearney Group, led by Founder and CEO Paul Kearney, is a dynamic and innovative financial services firm distinguished by its team of over 50 professionals, including dreamers, doers, pioneers, and visionaries. The firm is renowned for its integrated approach to financial advice, serving both individual and business clients. Kearney Group combines technical expertise with creative thinking to facilitate significant financial transformations for their clients, standing out in the financial landscape for its unique method of service delivery.

The services offered by Kearney Group include:

- Business Advisory: Strategic advice and support tailored to business needs.

- Private Wealth Management: Comprehensive wealth management and planning services for individuals.

- Strategic Lending: Customized lending solutions designed to meet various financial requirements.

Phone: 03 9428 8822

Website: https://kearneygroup.com.au/

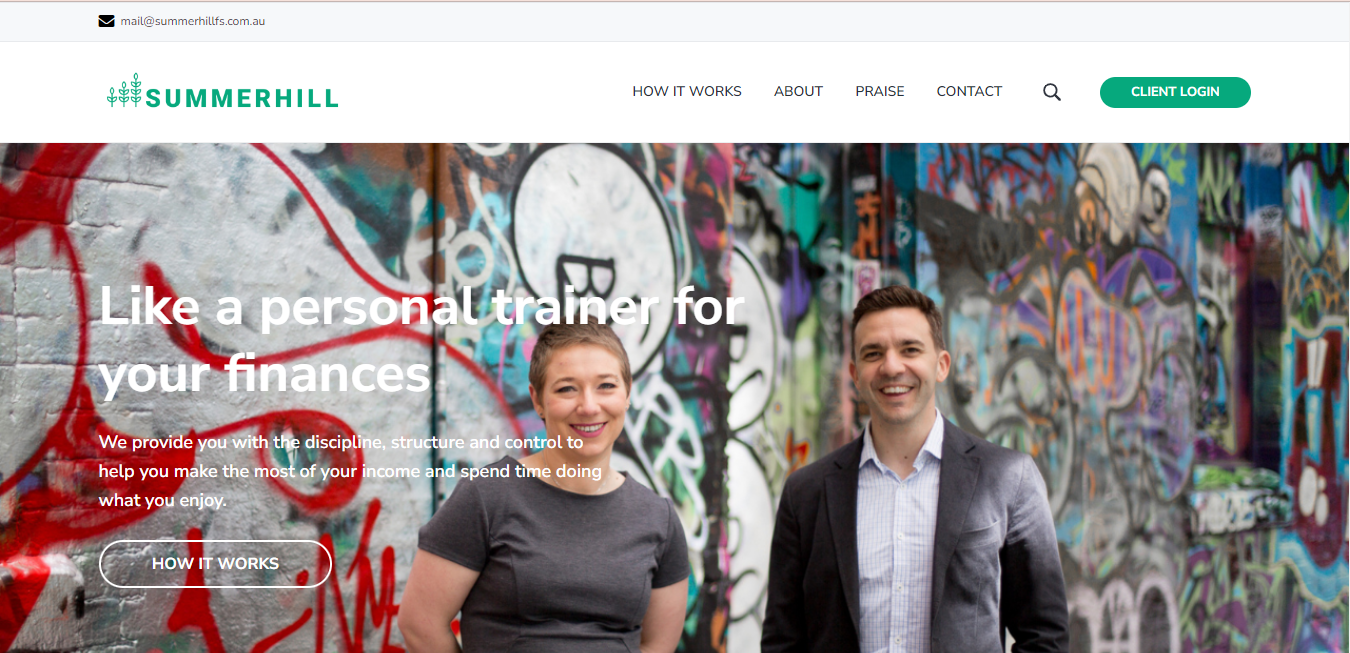

Summerhill Financial Services

Summerhill Financial Services operates with the commitment of a personal trainer for finance, providing clients with the necessary discipline, structure, and control to maximize their income and enjoy their chosen lifestyle. Led by financial advisor Alex Perini, the company caters to clients from different backgrounds, helping them understand and realize their personal and lifestyle ambitions. Emphasizing the importance of education, transparency, and customized strategies, Summerhill Financial Services works to improve clients' financial health and provide them with peace of mind, allowing them to focus on family, lifestyle, and career.

Services provided by Summerhill Financial Services include:

- Savings Boost: Advice on improving savings for various purposes via regular contributions.

- Investments: Development of appropriate investment strategies and contribution levels to achieve future goals.

- Lifestyle Funding: Creating investment portfolios tailored to support lifestyles that encompass travel, new experiences, and gourmet dining.

Email: mail@summerhillfs.com.au

Website: https://www.summerhillfs.com.au/

Verse Wealth

Verse Wealth, a financial advisory firm, specializes in providing comprehensive services to help clients optimize their financial resources. Their client-centered approach addresses major financial decisions including investment strategies, superannuation contributions, debt management, home purchases, business initiatives, and asset sales. The firm's philosophy centres on achieving a harmonious balance between meeting objectives, minimising stress, and fostering wealth growth for future freedom. Additionally, Verse Wealth excels in cash flow management, offering clients the tools to bring clarity and structure to their financial activities.

The services offered by Verse Wealth include:

- Strategy Development: Guidance on making significant financial choices.

- Cash Flow Management: Strategies for effective control of finances.

- Investment Planning: Crafting investment portfolios that align with client objectives.

- Superannuation Advice: Expertise in selecting funds, investment strategies, and contribution advice.

- Retirement Planning: Maximizing superannuation and considering conservative investment options.

- Tax Planning: Advice to ensure clients are not overpaying taxes.

- Property Advice: Consultation on buying or investing in property.

- Coaching: Financial education and emotional management in investments.

- Debt Management: Strategies for handling debt and liaising with mortgage brokers.

- Employee Share Schemes: Assistance with understanding and managing share schemes.

- Financial modeling: Linking resources and strategies to forecast financial futures.

- Estate Planning: Tailoring estate plans to reflect clients’ desires.

- Investment Management: Focused, goal-oriented portfolio management.

- Mortgage Broking: Identifying suitable mortgage solutions for clients.

Phone: 1300 822 165

Email: admin@versewealth.com.au

Website: https://www.versewealth.com.au/

Endorphin Wealth

Endorphin Wealth, operating as part of Wilson Pateras, takes a distinctive and personalized approach to financial advice. As a privately owned firm, they specialize in crafting financial strategies tailored to meet the unique needs, aspirations, and objectives of their clients. With a client-first philosophy and a team of high-caliber, award-winning financial advisors, Endorphin Wealth offers an exceptional financial planning service.

The firm is recognized for its commitment to comprehending the lifestyle clients desire both today and in the future, as well as their risk tolerance. This deep understanding forms the foundation for customizing investment decisions and portfolios to align with each client's specific circumstances. The financial planners at Endorphin Wealth invest time in building a profound understanding of their clients, enabling them to create financial plans and investment strategies that cater precisely to their lifestyles and goals.

Endorphin Wealth offers a range of services, including:

- Wealth Creation: This encompasses the development of investment portfolios, the management of super-investment risks, and tax minimization strategies.

- Retirement Planning: They provide expert advice on investments for retirement and transition to retirement planning.

- Wealth Protection: Endorphin Wealth offers comprehensive insurance coverage and advice, regularly updated to maximise benefits.

- Property Investment: Clients can benefit from advice on real estate planning and investment property.

- SMSF: The firm assists with the setup of self-managed super funds (SMSF) and diversified investment strategies.

- Business Planning: Tailored investment advice and succession planning are available for business owners.

- Aged Care Planning: Services include managing risks associated with super investments and implementing tax-efficient strategies.

- Mortgage Broking: Endorphin Wealth offers strategies for debt reduction and tax-effective debt structuring.

Phone: 03 8419 9800

Email: advice@endorphinwealth.com.au

Website: https://endorphinwealth.com.au

Toro Wealth

At Toro Wealth, the focus is on delivering tailored financial advisory services, particularly geared towards achieving retirement objectives. Their strategy is to offer personalized and impartial financial advice that resonates with each client's unique situation. This client-first philosophy ensures that the financial strategies crafted are not only practical but also well-aligned with the clients' personal goals and lifestyles.

Toro Wealth's range of services includes:

- Retirement Planning: Providing guidance on retirement plan options and income strategies.

- Tax Minimization: Implementing strategies to legally lower tax liabilities and quicken goal realization.

- Superannuation and SMSF: Specializing in the efficient setup and management of Superannuation and Self-Managed Super Funds.

- Savings Optimization: Advising on effective management of savings for future needs and emergency funds.

- Investment Management: Building investment portfolios that suit individual risk profiles and expected returns.

- Family Protection: Planning life insurance solutions to protect clients and their dependents.

- Income Maximization: Adjusting income strategies to improve the chances of meeting financial targets.

- Debt Management: Offering advice on reducing debts in a tax-efficient and effective manner.

Phone: 1300 447 599

Email: admin@torowealth.com.au

Website: https://www.torowealth.com.au/

Fee compression, disintermediation, investor shortsightedness, and younger clients' inexperience are some of the worries keeping advisors up at night.

The five reasons it is hard to be a financial advisor are high liability. Low barriers to entry/immoral competition. Hard to maintain a long term investment focus.

As it turns out, financial advisors rate their career happiness 2.7 out of 5 stars which puts them in the bottom 10% of careers.

A Financial Advisor is a finance professional. who provides consulting and advice about an individual's or entity's finances. Financial advisors can help individuals and companies reach their financial goals sooner by providing their clients with strategies and ways to create more wealth.

Putting it simply, being a financial advisor is HARD. So if you're looking for an easy career where you can sit back and coast, forget about it. It's not for you. Another high turnover rate is that many companies' training programs haven't adapted to the changing environment.