Welcome to our concise guide on the top 30 platforms offering affordable individual tax returns online in Australia! Tax season can be daunting, but we've compiled a list of the best online services that won't break the bank.

From user-friendly interfaces to expert guidance, these platforms cater to various tax situations, ensuring a seamless and cost-effective filing process. Join us as we explore the world of cheap individual tax returns online and discover the perfect solution for your tax needs in Australia. Let's get started!

Ultimate List Of The Best Cheap Individual Tax Returns Online Australia

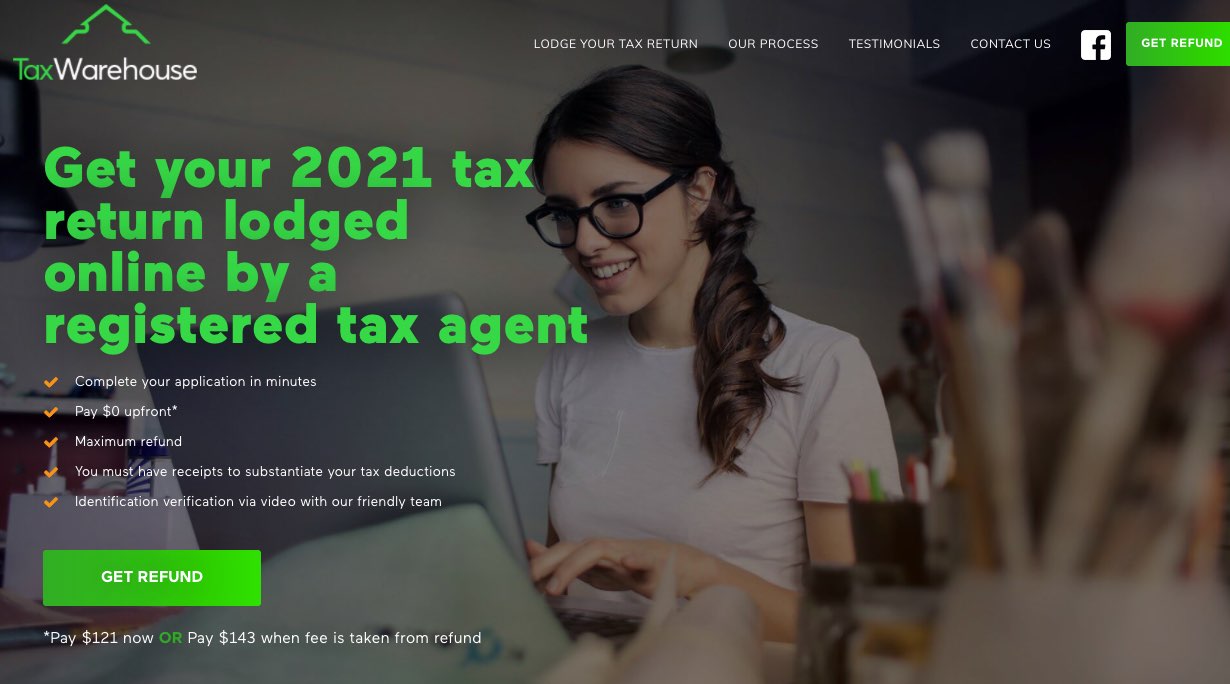

Tax Warehouse - Individual Tax Returns Online Australia

0407 418 209

Helps You Avoid Wasting Money and Time

It's convenient to be able to pay your taxes whenever it's most convenient for you by filing them online. Because we value honesty and openness, we won't surprise you with any extra fees or charges.

Reliable Australian Online Tax Accountants

Every year do you dread filling out your tax return? To put it simply, you need not anymore! Tax Warehouse is here to make filing your taxes simpler than ever by handling the entire procedure on your behalf.

Our service is quick and easy, letting you locate a qualified tax professional online and get your refund processed as soon as possible, all from the convenience of your mobile device. Tax Warehouse's pros will electronically file your return for you.

Their track record of successfully claiming the most allowable deductions to obtain the largest potential tax refund for your specific business type. You may trust your tax return to our team of experienced professionals. We get you the biggest return possible with the least amount of effort on your part, so you can stop dreading tax time and put that money in your pocket sooner.

Tax Window - Individual Tax Returns Online Australia

0401 117 311

Tax Window employs an award-winning approach to taxation, setting them apart from typical accounting firms. Their comprehensive services extend beyond the scope of traditional tax agents, offering expertise in various financial areas such as investment accounting and business enhancement.

Unlike many tax agents who charge exorbitant fees for their services, Tax Window takes a different approach. They believe in simplifying the taxation process, providing clients with understandable solutions that are tailored to their specific needs. Moreover, Tax Window stands out by offering industry-leading fees for its exceptional services.

One of the key aspects of Tax Window's service is its focus on delivering personalised tax strategies to each client. As a boutique tax practice, their team of tax agents pays special attention to individual clients, ensuring that their tax strategies are carefully crafted to minimise tax payments.

For those seeking investment planning assistance, Tax Window is a reliable partner. They possess unique insights into the Australian tax code, allowing them to develop strategies that keep their clients ahead in the financial game.

Business owners can also benefit significantly from Tax Window's expertise. The team understands the challenges of managing a business and the burden of compliance-related tasks. By entrusting Tax Window with their accounting and taxation needs, entrepreneurs can free themselves from the hassle of number crunching and focus on the growth and success of their ventures.

Tax Window's award-winning approach to taxation goes beyond the norm, offering exceptional services that cater to the diverse financial needs of its clients. Their dedication to providing understandable solutions at competitive fees sets them apart as a reliable and trusted partner in the complex world of taxation and financial management.

Austax Individual Tax Returns Online Australia

07 4725 2384

Individual Contributions and Individual Services

We simplify things for everyone, regardless of who you are or what you do. Our competent and experienced experts are here to take the stress out of meeting your tax requirements and, of course, getting the best possible result, and we are the largest preparers of individual tax returns in North Queensland.

Personalised Tax Services Australia

08 8271 4061

Here at Customized Tax Services, it is our mission to provide affordable, straightforward tax and business assistance. We aim to support you to such an extent that our service will be more than you ever imagined. We'll take care of you in a way that's both competent and kind. We will assist you regardless of the difficulty of your return, the age of your return, or your subjective assessment of your circumstances.

- If you need assistance filing your taxes as an individual or as a corporation, trust, or partnership, we've got you covered.

- To that end, we can assist you whether you have a single investment property or a portfolio of managed funds.

- No matter how many shares you have sold and bought or how active your portfolio is, we can assist you.

- We can assist you whether you have only one year of tax returns or several years worth.

- You can have us to assist you whether you have recently acquired, sold, or lost your business.

We give you a clear breakdown of the tax regulations that pertain to your situation and offer a no-cost quote before we even start working. Every time you work with us, we'll go above and beyond to ensure your satisfaction. We'll take care of you in a way that shows compassion as well as competence and speed.

Multiple Income Tax Returns

We have helped several customers file multiple income tax returns, some dating back as far as ten years. All of these customers have breathed a sigh of relief, and in many cases they have even been reimbursed.

Ex-Pats and Non-Residents

We have extensive experience in preparing and filing tax returns for both foreign nationals and permanent residents. If you will be out of the country for an extended amount of time, we can file your tax return for you. If you are temporary work visa, a non-resident on a working holiday, or short-term overseas transfer, we can help you file your income tax return with the Australian Taxation Office.

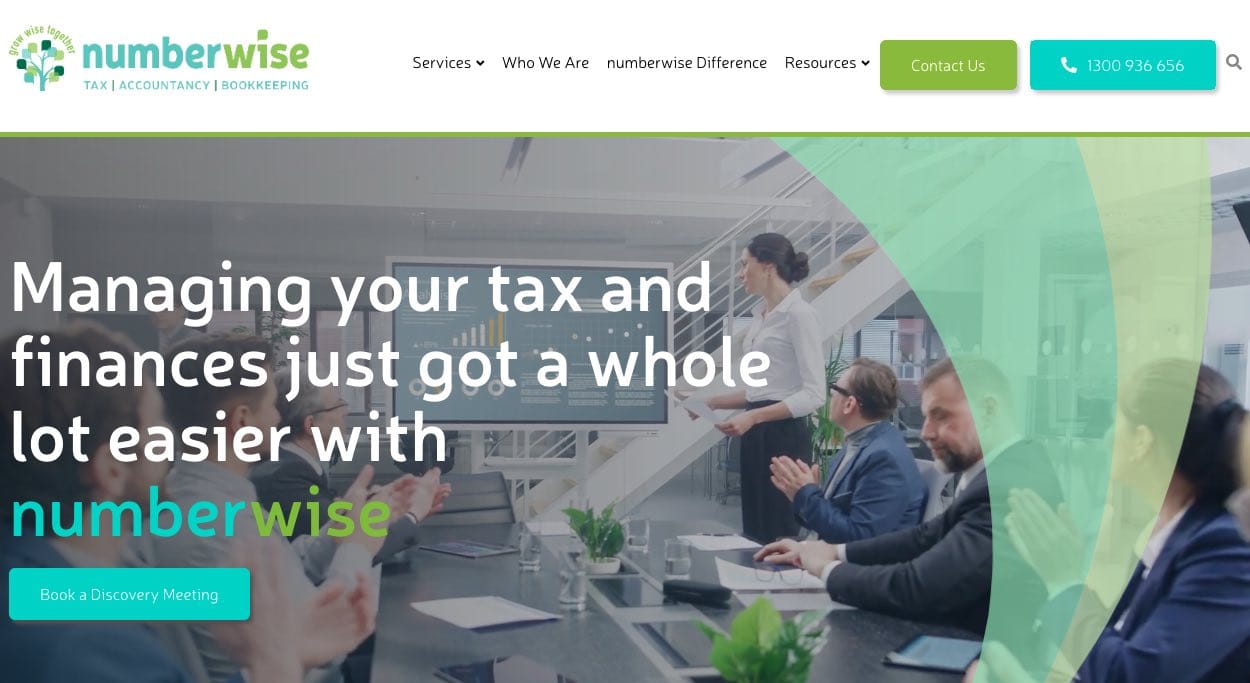

Number Wise Individual Tax Returns Online Australia

1300 936 657

We at numberwise consider ourselves successful only when our customers are. Numberwise has been in business for almost 30 years, providing tax and financial accounting services to corporations, their owners, and individuals. Maximize the value of your business and personal assets with the help of our timely guidance, accounting services, and experienced tax and strategic planning.

The first step in our process is building rapport of trust so that we can learn what drives you and your company. With this knowledge in hand, we set out to solve your most pressing problems and meet your most pressing needs while simultaneously keeping an eye on the bigger picture and getting you closer to your ultimate objectives.

There is no such thing as accidental success. It's the fruit of persistent effort, forethought, strategy, and gaze fixed firmly upon the future. In light of this, the motto "wise with numbers" is more than simply a slogan here at numbers; it describes how we conduct ourselves every day.

You receive what matters, competent counsel at a fantastic value, let's become wise together. Working with numberwise is like working with a major firm without the pretension and the expense.

Numberwise

Your financial security, whether personal or commercial, is our first priority. When it comes to numbers, numberwise has a team of professionals with a combined 25 years of knowledge. We're here to help with all of your bookkeeping and tax preparation needs, whether you run a multi-million dollar corporation or a one-person operation.

Numberwise is your partner for success

Talk to one of our tax experts; we have a staff of knowledgeable tax experts who will invest the time necessary to learn about your unique situation and objectives. An in-depth discovery approach forms the basis of our client relationships, allowing for preemptive and forward-thinking tax preparation. We offer comprehensive, year-round tax planning services that take into account both your business and personal objectives. This allows you to make crucial choices in the moment that forwards your aims. Our goal is to foresee problems before they arise, allowing us to make adjustments so that tax season is as stress-free as possible.

Numberwise is familiar with the nuances of individual and corporate taxation and how they can effect your bottom line. We take a holistic view of your financial situation and provide tailored recommendations to help you succeed. Expert tax advice is just a phone call away; contact us now to learn more about how we can put our arithmetic prowess to work for you.

Tax Refund On The Spot Australia

1300 768 286

Members of the team at Tax Refund on the spot are certified accountants with extensive experience in the tax industry. Our goal is to get you the largest possible tax refund by maximising all of the credits and deductions available to you. Moreover, our company is distinguished by its ability to issue instantaneous tax refunds.

Services

Home Loan

The search is over if you need money for a home improvement or automobile purchase. Our lending services have a fast processing period, so you can acquire the money you need without waiting around. Everyone is welcome here, even those who, like self-employed people, have problems getting loans from conventional financial institutions. To make sure you get the finest loan terms available, we provide complimentary consultations and evaluations.

We provide financing and refinancing solutions for businesses, in addition to automobile and truck loans. We are here to assist you in locating the optimal answer for your situation. Simply submit our online form for an immediate preliminary evaluation. The greatest advise and lowest rates can be found with the help of our professional staff. Why hold off? Get in touch with us immediately to find out how we can assist you in reaching your financial objectives.

Tax Return

Want to get your tax return without the hassle? With only three easy steps, we've made the process as painless as possible. And because it's all web-based, you may collect your refund from anywhere in Australia.

We're different from other tax refund businesses in that we don't ask for money up front, so you may start the process without worrying about finances until your return is ready to be disbursed. To top it all off, you can rest assured that you are receiving the largest refund allowable by law thanks to our team of seasoned tax experts.

First, fill out our no-obligation tax refund estimate form and one of our tax professionals will be in touch to help you get started. To ensure you receive all the money you are entitled to, we will assist you in locating any unclaimed PAYG from the current or previous tax years.

The time between approving your return and being able to get your hands on your cash is typically under an hour. Additionally, we can provide you with up to $1000* in same-day payouts, allowing you to acquire the money you need, when you need it. You may rest assured that the remaining money will be paid out to you within 7-10 business days.

How Are We Different?

Searching for a simple and quick way to complete your tax return? We offer assistance from a group of certified public accountants. To ensure you get the largest refund possible, we'll double-check your tax return. We want to make the whole process as easy and stress-free as possible for you, therefore we conduct all of our interactions with you over the phone, over email, and by short message service (SMS). Your tax refund can be put into your bank account or picked up in cash from our office when you're ready to withdraw it.

We make it easy to collect your tax refund in as little as one hour by having you fill out our online form and having one of our tax agents analyse your return. If you've misplaced your PAYG summaries from previous years, we can help you track them down and claim any refunds that were rightfully yours. We've filed more than 36,000 returns with the Tax Office, and our entire service is available online so that we can serve customers wherever in Australia, including in remote regions of Western Australia, South Australia and Queensland.

Q Tax Individual Tax Returns Online Australia

1300 047 829

About Us

When it comes to filing taxes in Queensland, QTax has been doing so since 1978. Many thousands of people in Queensland have benefited from the services we've provided over the past 15 years; we've prepared over 500,000 tax returns for them. Our company has over 40,000 annual clients and employs 100 or more tax consultants across 30 or more locations during tax season (1st July - 31st October). We take satisfaction in the fact that our clients include sole proprietors, partners in businesses, corporations, trusts, and retirement plans, as well as students and faculty members who work part-time while attending school.

More than 30 seasonal locations, spread out over the state from South East Queensland to Mackay, complement our 13 year-round establishments. And so, why delay? Use QTax as your trusted tax advisor now. Taxes Made Simple with QTax.

Why Make Qtax Your Tax Agent?

Unlike many others who only open in the tax season, we at QTax are here for you all year round in our office locations.

- Rental Property Returns - Do you know what items are depreciable and which aren't? We can take the confusion out of preparing returns and help you get the maximum deduction for your rental property.

- We Know What You Want - QTAX is the name you know. We have been operating on and near the Peninsula since 1978. We are still here because we pay attention to detail and do the best possible job.

- Pay Nothing Now - You can have your tax return done today, and you won't pay anything until your REFUND comes back. The small additional fee covers all handling, bank and administration costs.

Our services include the following:

Preparation of Tax Returns for:

Salary, shares, capital gains, rental properties, trusts, companies, partnerships, and self-managed super funds are just some of the ways that people can produce money and manage their finances (SMSF). One's personal situation and financial objectives should guide their decision.

Preparation of Business Activity Statement (BAS) for:

While starting a business or handling one's funds, one can choose from a number of various legal forms for doing so. Sole traders are individuals who have obtained an Australian Business Number (ABN) to engage in economic activity in Australia, while corporations are independent legal entities that can offer goods and services to the public and so create revenue. In a partnership, two or more people work together for the purpose of making money, while, a trust is a separate legal body that can own property and generate income for the benefit of its beneficiaries. Each business owner needs to carefully consider their unique situation and long-term financial goals before making a decision about the best legal form for their company.

Bookkeeping for:

Making money and handling money can be done in numerous ways. Personal income can come from a variety of sources, including but not limited to: a job, a business, a rental property, shares or capital gains. Businesses function independently as legal entities, earning money through activities including product or service sales and financial investments. Contrast this with a trust, which is a legal entity that holds assets and generates income for the beneficiaries, and you can see why the latter is preferable to a partnership in terms of income generation. At last, there is a sort of superannuation fund known as a self-managed super fund (SMSF) that gives account holders complete control over their retirement assets. How one handles their money is a matter of personal preference and the financial situation they are trying to achieve.

Setup and Formation for:

There are various ways to structure enterprises and manage funds in Australia. Corporations are distinct legal organisations that can earn money through activities like product or service sales or financial investments. Trusts are legal entities that can keep assets and create income for beneficiaries, while partnerships involve two or more people working together for financial gain. An Australian Business Number (ABN) is a unique identifier used by enterprises, and Self-Managed Super Funds (SMSFs) enable individuals to take charge of their own retirement funds. Goods and Services Tax (GST) is a (VAT) value-added tax that businesses in Australia are obligated to collect on sales of goods and services. The structure and method of managing one's finances that is best for a given set of circumstances and objectives must be tailored to the specifics of each case.

H & R Block Individual Tax Returns Online Australia

13 23 25

Your Tax Return Your Way with H&R Block

Our company is dedicated to simplifying the tax preparation process. We have been Australia's go-to tax specialists for nearly 50 years because we love statistics and always produce excellent outcomes.

Conclusion

When tax season approaches, it's crucial that you're prepared. You can trust Tax Warehouse, an established Australian online tax accountant, to assist you with filing your taxes electronically and receiving your return as quickly as possible. To help you file your personal income tax return and find out if you qualify for any tax deductions, they present you with some pointers. In addition to providing a fast and painless procedure, they have a proven track record of maximising your refund by claiming all of your legitimate deductions. For North Queensland residents looking for simple, low-cost tax and business advice, AUSTAxtsv.com.au is your best bet.

Foreign nationals and permanent residents alike can make use of their individual contributions and individual services, as well as their multiple income tax returns. They are quick to respond to enquiries, knowledgeable about tax legislation, and friendly towards clients. Numberwise is an accounting firm that helps businesses and their owners with their taxes and finances by providing expert advice, bookkeeping, and tax and financial planning. They have a group of experts with a combined 25 years of experience who provide year-round, all-encompassing tax planning services that take into account both corporate and individual goals. They look at the big picture for their clients' finances and then make specific suggestions for improvement.

Content Summary

- We'd like to help you get ready for tax season by giving you some advice.

- Hence, you may be wondering what the best strategy for submitting your taxes this year is.

- Send in your tax returns early for next year with our guidance and send them in electronically.

- Despite the holiday rush, it is possible to file your personal tax return by the due date.

- In order to facilitate the filing of tax returns, Tax Warehouse is here to take care of everything for you.

- You can have your return filed electronically by the experts at Tax Warehouse.

- As the largest preparers of individual tax returns in North Queensland, our team of knowledgeable and skilled professionals is here to alleviate any concerns you may have about fulfilling your tax obligations and, of course, achieving the best possible outcome.

- Tailored Tax Preparation Please contact us at 08 8271 4061 or australia.burford.com.au Our goal at Tailored Tax Services is to be your go-to source for low-cost, no-nonsense tax and business advice.

- We promise to treat you with the utmost professionalism and consideration.

- Whether you're a person or a business such as a corporation, trust, or partnership, we can help you file your taxes.

- Whether you need help with a single year's worth of tax returns or several years' worth, we're here to help.

- Filing Several Annual Tax Returns Several of our clients have asked us to prepare tax returns covering periods of up to ten years.

- Non-citizens and former expatriates We have years of practise in completing tax returns for both non-U.S. citizens and permanent residents.

- We can submit your tax return on your behalf if you will be out of the country for an extended period of time.

- To businesses and their owners, as well as individuals, Numberwise has been offering financial and tax accounting services for than 30 years.

- With our quick advice, accounting services, and seasoned tax and strategic planning, you may increase the value of your business and personal assets.

- Given this, the phrase "smart with numbers" is more than just a slogan around here; it encapsulates the values and principles upon which our company was founded and which continue to guide our daily work.

- numberwise provides all the benefits of working with a large company without the ego and the price tag.

- Together, the experts at numberwise have more than 25 years of experience in the field of numbers.

- Whether you are a multimillion dollar corporation or a one-person enterprise, we are here to assist you with all of your bookkeeping and tax preparation needs.

- We at Numberwise are here to be your success partner. Have a conversation with one of our tax professionals; we have a team of qualified tax professionals who will take the time to get to know you and your goals.

- We provide year-round, all-encompassing services for tax planning that are tailored to your specific business and personal needs.

- Numberwise knows the ins and outs of personal and business taxation and how they might affect your bottom line.

Frequently Asked Questions About Individual Tax Return

An individual tax return is an official form that a person or a married couple submits to a federal, state, or local taxing agency to report all taxable income received during a specific period, usually the previous year. This record is used to assess the amount of tax that is due or was overpaid for that period.

You must lodge a tax return if any of the following apply to you. You: had tax withheld from any payments (such as wages) made to you during the income year. are an Australian resident and your taxable income was more than the tax-free threshold ($18,200).

If you haven't filed your federal income tax return for this year or for previous years, you should file your return as soon as possible regardless of your reason for not filing the required return.

An individual tax return is an official form that a person or a married couple submits to a federal, state, or local taxing agency to report all taxable income received during a specific period, usually the previous year. This record is used to assess the amount of tax that is due or was overpaid for that period.

ITP Accounting Professionals Australia

1800 367 487

Why Choose ITP Brighton?

If you're looking for trusted tax accountants in Brighton, then you've come to the right place.

The beautiful city of Brighton is full of life and exciting surprises. But if you're bogged down with taxes, it's a little difficult to enjoy the city you know and love.

That's why ITP Brighton allows you to get in touch and communicate to our tax agents your various concerns and requirements for your personal or business tax needs. Our experienced accountants know how to find all the details you need to get the right tax deductions so you can get the tax returns you deserve.

Why trust ITP? The company has over 50 years of experience offering financial services for employees and business owners who need an extra hand in organising their budgets and accounting departments. In short, we do a hassle-free job of making sure all the numbers match.

So whether you need assistance in individual tax returns, general bookkeeping and other accounting activities between and among companies, we at ITP Brighton are here to help you make sense of it all. So come into our office, make yourselves comfy and talk to us about your tax-related concerns.

Do you need help with something more complex than preparing tax returns and general bookkeeping? Don't worry; our tax agents ITP Brighton are highly adept at solving any accounting problems you or your business may encounter. Whatever needs you to have, you can count on an ITP Brighton tax agent to set it all straight for you.

ITP Tax Accountants look for ways to minimise your tax liability and maximise your deductions and will need certain information to help you with your tax return. Below is a list of documents to bring with you. Any questions? No problem. Simply call your local ITP Accounting Professional, and they will tell you exactly what you'll need to bring in.

Tax Return Australia

0499 829 829

Maximising your tax return is easy when you have the help you need. TaxReturn.com.au is based on this principle. No one truly enjoys rummaging around for receipts and other documents involved in the entire financial process. Lodging your tax return is a tedious job, which is why many people are tempted to rush through it. With TaxReturn.com.au, we want to assist you in providing the correct details and declaring all the income that needs to be declared. This way, you never miss out on deductions, and you can claim what is rightfully yours.

TaxReturn.com.au allows lodging returns online quickly and efficiently. On average, Australians take hours to days to finish their tax return. With our help, you can complete yours in just a few minutes. You can even access your account anywhere using your laptop or smartphone. So save your tax return and get back to it anytime you want.

Our expert accountants are professional yet friendly. Plus, our services are fast, convenient, and affordable. So when it's that time of the year again, choose TaxReturn.com.au, the trusted experts in tax agent services in Australia.

Our Mission

Tax returns can seem daunting, especially if it is your first time to lodge. It's why we make it our mission to make the entire process as easy and hassle-free as possible.

- Your peace of mind is one of our primary goals.

- Our clients always come first. Your best interests are our top priority. And here at TaxReturn.com.au, you can trust that you are in the best hands. It's why we strive to meet expectations while staying transparent with you.

- We provide the best in personalised tax return services.

- Our expert staff makes it possible for us to give excellent assistance to all our clients. We work closely with businesses, employees, and homeowners to understand what matters most to each of them.

- We respond quickly.

- Part of our customer-centric business is to provide a fast response to our clients. "There are no simple questions, just simple answers." Whether you need clarification or inquire about our services, all you need to do is contact us. One of our talented staff members will be ready to help you.

- Our fees are cheap and straightforward.

- You will never have to worry about hidden charges – because there are none! We call it as it is.

TaxReturn.com.au works with individuals and businesses. We are seriously dedicated to helping each client minimise their taxes.

ETax Accountants Australia

1300 693 829

What is it about Etax that makes us Australia's favourite online tax return?

- No appointments – ever.

- Finish your tax return online, fast. Wherever you are – on any device.

- Secure uploads directly into your Etax account storage.

- Friendly accountants to help you via live chat or private messaging.

- Confidence your tax return is correct, AND you received the best possible tax refund.

Etax won the Product Review award for both 2021 and 2020 and the Canstar Blue 2018 and 2020 "Most Satisfied Customers Award" for tax agents.

Customer reviews about Etax mention friendly service, excellent value, the great online tax return, better tax refunds, and the comfort of knowing your tax return was done right.

The ratings speak for themselves! Etax is Australia's best-rated tax agent on Product Review, Facebook, Google and TrustPilot.

What's the best way to do my taxes?

The Etax teams of tax accountants and software experts work all year round to make your tax return easier and improve Etax service and support.

Annual upgrades and improvements at Etax are based on the kind, thoughtful feedback we receive from Etax users. Thousands of people answer Etax surveys each year, and your smart suggestions have helped to make Etax amazing.

Taxopia Individual Tax Returns Online Australia

1300 829 674

Professional Accountants & Registered Tax Agents

The Taxopia team collectively has more than 40 years of professional business accounting and advisory experience. We are a progressive accounting firm with full public practice certification, registered tax agents, and ASIC agents. We have previously contributed tax and business commentary to financial publications such as the Australian Financial Review, BRW and the Flying Solo Small Business Forum. We have lodged thousands of business tax returns, business activity statements, company tax returns and trust tax returns. Our solutions are of an exceptionally high standard and represent unrivalled value for Australian small and micro-businesses.

Based In Melbourne Servicing All Of Australia

Based in Mount Waverley, Melbourne, Taxopia is a progressive online accounting firm. We use state of the art solutions to ensure your sensitive company or trust tax information are kept safe and confidential. So it doesn't matter if your business is based in Brisbane, Sydney, Perth, Adelaide, Melbourne or anywhere in between. Taxopia offers great tax accountant solutions for all locations throughout Australia.

Low Cost But Great Service

Taxopia offers professional and cheap online tax returns and accounting at a price significantly cheaper than other business accounting firms. We keep costs down by ensuring Taxopia uses the newest systems and procedures to streamline tax return workflow. In addition, all documentation and communication is prepared and signed electrically, which is how we can offer cheap online tax returns.

Are you searching for cheap individual tax returns online?

Taxopia are the tax experts for you! Taxopia is Australian owned and based in Melbourne. We use state of the art solutions to ensure your sensitive company or trust tax information are kept safe and confidential.

Although we are cheap, our service is top quality, and our tax accountants are professionally qualified!

Taxopia offers individual annual tax returns. If you'd like, we can also provide quarterly BAS solutions. Our extensive expertise means we can offer more complex tax advice if required.

Do you have previous years' tax returns outstanding? Taxopia can lodge those as well.

Tax Ware House Individual Tax Returns Online Australia

407418209

The Online Tax Accountants You Can Trust in Australia

Do you dread completing your tax return every year? Well, now you don't have to! Here at Tax Warehouse, we make the process of submitting your tax return easier than ever, and we do it for you!

Our service is fast and simple, allowing you to find an experienced tax agent online and have your tax refund completed and processed as quickly as possible, and it can all be done from your mobile phone.

The tax agents at Tax Warehouse submit your tax return online for you.

Their proven experience in claiming the most deductions that return the highest possible tax refund based on your industry. We give you the confidence knowing your return is in the safe hands of fully qualified and registered tax agents. We maximise your return amounts and minimise the work on your end, so you no longer have to dread tax season and can use that tax refund money a little sooner!

What to expect from our tax agent online services?

No matter who you are or what industry you work in, our online tax advice is suited to you. We cater to a wide range of people, from contractors and those in the construction and trades industries and corporate and creative professionals, retail employees, rural workers, school teachers, office workers, social workers, or anybody required to lodge an Australian Tax Return. So whether you're located in Adelaide, Mildura, Melbourne, Sydney, Brisbane, Perth, Darwin, Gold Coast, Cairns, Townsville, Hobart, Shepparton, Swan Hill, Portland, Sale, Toowoomba, Broome, or elsewhere throughout Australia, our online tax accountants can make sure you maximise your return in just a few minutes. In addition, the tax Warehouse knows what you can claim as a tax deduction. This ensures you get a great tax return each year.

One-Stop Tax Australia

(02) 8373 5917

Have a dedicated CPA tax accountant to prepare your tax return online

This is NOT a Do-It-Yourself or automated online tax return system. We do all the hard work for you! At One Stop Tax, all returns are prepared EXCLUSIVELY by a dedicated CPA Tax Accountant to ensure you will get the maximum refund you are entitled to. Simply fill in our simple assisted online tax return questionnaire and upload your tax documents. We will take care of the rest.

New Wave Individual Tax Returns Online Australia

(07) 55041999

Your Trusted Gold Coast Accountants

We Help Businesses Minimise Tax & Maximise Profits!

We're not your typical dinosaur accountant. Over 800 entrepreneurs and business owners on the Gold Coast have started, grown & scaled their business using ours outside box Accounting, Advisory & Bookkeeping Services.

How much does your Accountant & Bookkeeper cost Your Business?

Imagine where you would be if your business saved an additional $10k, $20k, $50k or even $100k in tax each year.

You can use this money to invest more in marketing, hire additional employees or simply increase your own bonus for all the hard work you've done over the years. You'd be able to lift a big weight off your shoulders in terms of being financially secure and feel like your business is finally moving forward.

Ask yourself are you:

- Tired of handing over your hard-earned money straight into the pockets of the ATO? (Yes, we agree that everyone should pay tax, but not more than they have to).

- Tired of not knowing where your business is at, how much tax to pay, or whether you're even making money?

- Tired of your typical DINOSAUR accountant, who you only hear from once a year and provides you with zero valuable advice?

Our Chartered Accountants & Business Advisors team will help you stop the stress & anxiety of trying to guess the financial position of your business with our 'outside the box strategies.

These are the same strategies that:

- Identified that a Labour Hire business overpaid $200,000+ in tax when we reviewed their last 2 years of tax returns;

- Saved a construction business over $88,000 in tax when they sold their business;

- Allowed an electrical business to save rent by purchasing commercial property through their Super;

- Grew a Beauty salon's sales by 100-150% year on year;

- Allowed a rapidly growing online store to forecast their cash flow and make the right decisions before it was too late.

These are just a handful of successful client stories. We want to help you become one of them. How much is your current accountant costing you? If the answer is "Cheap", then I can guarantee that they're not putting in the time or effort to allow you to achieve these types of results. You may be missing out on thousands.

Ezy Tax Back Australia

How does our process work? Maximum refund guarantee!

It's simple, whether you sign up for a yearly, once-off, or our express online tax return lodgement service, we guarantee a maximum refund! Once you lodge your form, our CPA accountants will process your return. They'll make sure all your information is correct, and they'll ask questions to make sure we are maximising your eligible legal tax deductions.

Applies to Australian Individual Income Tax Returns for one financial year. Unlike our competitors, we do not charge extra for rental property, foreign income and other additional schedules. It's one fixed price for your online tax return.

Online Tax Australia

(03) 9852 9051

Online Tax Australia is a family-owned business operated by three brothers (Brendan, Michael and Stephen).

Our team is highly qualified and well versed in what is required when lodging a tax return using an online service. We each have more than 20 years of experience in taxation, accounting, and business planning and management.

We guarantee a qualified tax agent checks every single tax return submitted with us so that any questions or items requiring clarification are resolved before the return is formally lodged with the ATO.

Promising affordable, fast tax returns and the highest customer service standards, it's no surprise that Online Tax Australia has processed over 45,000 tax returns.

How Online Tax Australia Works

Our simple, streamlined online tax return service involves just three quick and easy steps:

- Answer a series of simple 'Yes' or 'No' questions.

- Enter your information into our user-friendly worksheets.

- When you are comfortable, submit your return for review and lodgement by our qualified, experienced tax agents.

Free Trial Access: Should you complete a return and decide not to submit it for review and lodgement by us, then no fee is payable.

There is no pressure to complete your tax return in one sitting. If you have questions or require additional information, simply click on the 'Save and Log Out option. You can come back to your return at a future time. This allows you to contact us to discuss any questions or collect any missing information before submitting your tax return.

Once your return is submitted with us, our tax agents will undertake a comprehensive review. If we have any questions or items requiring clarification, we'll contact you directly. Rest assured, there is no additional cost involved for our review service. Finally, we lodge your tax return with the Australian Taxation Office (ATO).

Our support services are available all year-round to assist you with any questions or ATO related issues. So you can count on year-round peace of mind with OTA.

Our Services & Pricing

As of 2018, the Australian Taxation Office (ATO) has implemented major changes to the review process that all tax returns undergo. These changes mean the taxpayer has a greater responsibility than ever before to ensure accurate tax returns. OTA's comprehensive services provide all you need to complete and lodge a tax return that is as accurate as possible. Our experts log into the ATO portal on your behalf to confirm all available data such as interest income, dividends and Government payments. We correct your tax return (if required) before it's lodged with the ATO, reviewing your tax deductions to ensure accuracy and compliance with taxation laws. Our process greatly reduces your exposure to ATO adjustments, penalties and interest.

Our Premium Pre-Fill Service: Making Tax Even Easier

For just $10 extra, you can benefit from Online Tax Australia's Premium Pre-Fill Service, making the tax return process even simpler and quicker for you. With the help of our Premium service, Online Tax Australia will do the tedious work of sourcing and entering all the relevant information available through the myGov portal. This includes PAYGs, interest, dividends, Centrelink information, HECS/HELP and more. Then, all you need to do is enter your personal information and tax deductions. That's why, when you choose our Premium Pre-Fill Service, we help to make the already-simple process of completing your tax return even easier and less stressful.

7 Great Reasons to Choose Us

- An experienced, professional tax agent checks every return.

- Access to professional, experienced, qualified, transparent accountants to answer all your questions.

- Convenient, fast and simple to use software exclusive to OTA. Tax returns can be completed in 15 minutes from the comfort of your home or office.

- Affordable, fixed price fee (which is completely tax-deductible).

- Tax refunds within 10 to 14 days (subject to ATO processing).

- Safe, secure, ATO-approved website operated with integrity.

- Free to try. No obligation. If you complete a return and decide not to submit it for review and lodgement, no fee is payable.

OTA does not charge interest or late payment fines or subscriptions.

Tax Today Individual Tax Returns Online Australia

1300 829 863

Instant Tax Refunds

How does it work?

Tax Today are Australia's largest provider of the Same Day Tax Refunds. With over 14 branches across Australia and online tax returns, we are really leading the way.

At Tax Today, you can get a professionally prepared tax return and then instantly have your tax refund paid to you. This can either be in a cashable cheque or a direct deposit to your bank account within the hour.

That's why we are called Tax Today. Most refunds are paid at the time we lodge your tax return. That's almost as fast as an ATM.

Astro Accountants Individual Tax Returns Online Australia

07 3180 3161

People - Planet - Purpose

Simply put, the people we interact with, the environment we create, and why we help are at the forefront of our business. The team at Astro are passionate about supporting people to become better money managers both in business and as investors. In turn, we believe if you have a strong financial position, you are more likely help others, pass on your knowledge and live your best life.

Strategic business & Investment advice

If it's time to get your finances sorted once and for all, then it's time to get a professional involved. Your accountant will work with you, reviewing your structure, cash flow, and profit to ensure you are meeting your business obligations. Deal with an accredited firm that has great communication with quick response times.

Tax & advice available online

Tax can be one of your biggest expenses, and missing a lodgement date can cause even more pain to your pocket. We provide strategic advice for companies, trusts, SMSF & property owners. We can help you restructure your affairs to ensure you meet your ATO obligations, reduce your risks, and minimise your tax.

Our team will ensure you are kept up to date and aware of your deadlines. We also provide you with apps that will save your deductions online and extract the data for easy access when you need it.

Isn't it time you upgraded to an Astro Accountant?

- We prepare all ATO and ASIC documents.

- Restructure and strategic tax advice.

- Establish new company and trusts

- Provide business coaching and Xero training

- Help you understand your numbers

- Discuss ways to reduce debt and increase cash flow

- Alert you to lodgement deadlines.

- We use Receipt Bank to ensure you have all your receipts.

- We will show you smarter ways to manage your investments.

- We provide complimentary phone advice for all our registered clients.

Maurer Taxation Individual Tax Returns Online Australia

0438 960 990

All your Individual and Business Taxation needs, solved

5+ Years Experience

We specialise in tax, so you don't have to. We offer the full suite of taxation needs such as Individual tax returns, Sole trader tax returns, company, partnership and trust tax returns, as well as consultations and ATO representation.

Get The Maximum You're Entitled To

Our tax accountant has a wide range of experience in all occupations and industries to know what you can claim to get the best possible result at an affordable price.

We Do Everything

We are a locally run, family business that is here to support to you/your business. Our tax accountant has extensive knowledge and experience in rental investing, international taxation (expat's), cryptocurrency, shares/managed funds, capital gain tax, small business and personal services income (PSI).

Tax Returns

- Tax returns are prepared and lodged efficiently by a friendly and supportive tax accountant.

- Same day lodgement means your tax refund comes quicker.

- Individual, ABN, Partnership, Company and Trust Returns available.

Taxation Advice And Planning

- Consultation and advice sessions to answer any of your tax questions.

- Entity creation such as ABN, GST Registration, Company/Partnership/Trust Setup.

Mulcahy & Co. Individual Tax Returns Online Australia

1300 204 781

Full-service financial solutions for individuals, businesses and farmers.

We are helping you achieve financial security.

Mulcahy & Co is your hub for professional accounting, taxation, financial planning, legal, loans and finance and marketing services.

We have provided specialised personal services for businesses, farmers, individuals, and retirees for more than two decades.

Qualified Sunshine Coast accountants, tax experts and business advisers to help you achieve financial security.

Our team of qualified accountants & tax experts will advise you on managing your money best and help get you closer to financial security. Accounting and taxation are about so much more than compliance. At Mulcahy & Co we provide accounting, taxation services, advice and support to ensure you get the best value for your dollar.

The first question our accountants will ask any client is: are you financially secure? Our mission is to ensure our clients understand what it means to achieve and maintain financial security.

Mulcahy & Co are Sunshine Coast accountants, and we offer cloud accounting services and partner with lead cloud accounting software providers Xero, which we also use for our bookkeeping services.

Our accountants are experienced and professional business planners. We offer end-to-end business planning services, including expert advice and support in building a business, business health checks, business succession planning, starting a business and strategic planning.

At Mulcahy & Co Sunshine Coast, taxation and accounting assistance for individuals are another strong point of our services. Our tax accountants are the best in the business, while we also specialise in assisting clients with accessing government services such as youth allowance and pensions. Need help with your ATO tax return? Give us a call today.

SMSF (Self-managed super fund) compliance assistance and support, and succession planning are also among our accounting and tax accounting services.

Check out some of our services below, contact us for more information, or speak to one of our professional tax accountants.

Accounting Services

Bookkeeping

The days of detailed and tedious manual data entry are over, with cloud accounting software revolutionising bookkeeping.

Business Planning

We understand that business owners face a lot of challenges in today's climate. We can help you with all aspects of business planning.

Cloud Accounting

Cloud accounting software has many benefits. From security to data backup and redundancy, to access your financials from anywhere.

Individual Tax Returns

We offer a complete financial services package to individuals to help them achieve their financial goals.

SMSF Compliance

Self-managed super funds are most beneficial when they are fully compliant with taxation and superannuation laws, which can change.

Succession Planning

As retirement is inevitable for all business owners, succession planning is vital for the long-term survival of private businesses and farming enterprises.

Taxation

Our tax accountants are experts when it comes to all things tax and prides themselves on the quality of taxation services we provide.

Government Services

Navigating your way through government services can be difficult. We can help you.

Business Valuations

Business valuations can be invaluable. When you're refinancing, creating a business plan, looking to sell or exit your business, a valuation can be a critical step that allows you to move forward with a clear indication of your situation.

Express Tax Back Australia

1800 739 739

Proven "Tax Back System" gets more tax back and quicker!

Our closely guarded "express tax back system" is designed for backpackers, travellers & students to guarantee the maximum tax refund possible in the shortest time.

We are happy to give you a Free Quote on how much you will get.

It does not matter when or where in Australia you worked, and it is never too late or too early to claim your Australian tax back. Did you know you can claim your tax refund for any jobs in Australia for up to the last 12 years?

No upfront payment. We will take out the low fee once we have secured your refund.

Free document retrieval service

Don't worry. Our "document recovery team" will contact your employer and government departments on your behalf and retrieve all the necessary documents. It's a free service.

Our policy is "No Refund-No Fee". Therefore, if you are not entitled to a tax refund, we do not charge a fee.

With our many payment methods, you can decide how you will receive your refund.

Not happy with your tax refunds?

Our "tax back checker" can correct any mistakes to get you the refund that you are entitled to. Our policy is "no refund, no fee", so there is no risk to you. It is free to find out if there is more money. Are you going home? Get your tax back now!

If you are leaving Australia, you can get your tax back now and have it deposited into your Australian bank account before you depart.

Are you working to the very last day? Let our office organise the paperwork before you finish work. Then, we will collect the paperwork from your employer and organise your tax back and super refund.

Your money can then be deposited into any bank account in any country, or we can post a cheque.

Not in Australia - no problems!

Our clients are worldwide, so we specialise in clients, not in Australia. Plus we give the best refunds, have the easiest documents and the lowest prices. But there is more!

We have been in business for over 21 years and offer the Guaranteed Refund Service. Your tax refunds can be directly deposited into any bank account. In any country, you can't go wrong!

East Partners Individual Tax Returns Online Australia

(08) 8362 3488

We're Not Merely Business Accountants

We're here to make a real difference to our clients. Delivering a high-quality, efficient compliance service is just part of that. Helping our clients to develop, improve and grow their business is the next natural step. Our Business Development offerings are valuable and tangible services that create long term value for clients.

How East Partners Help With Your Accounting

We see traditional accounting and tax services as an important part of business life that must be given the attention and respect it deserves.

The majority of accountants are pretty good at checking your data and then putting the right number into the right box so that the Tax Man doesn't come knocking on your door.

We are different

We bring out the story that the numbers tell and explain it in plain language so that you understand it. We make sure that all the regulatory reporting that needs to happen is completed but, more than that, bring you a deeper into the numbers and what they mean for the health of your business.

How We Help You To Grow Your Business

Business can be tough, especially when you feel as though you're doing it on your own. Our business advisory services are designed to ensure that you're not alone during the ups and downs of business life.

We help to unpack your business purpose and ensure it is aligned with your personal purpose. This is the fundamental key to our advisory process.

Our accounting & financial services are tailored to suit you. It could be as simple as a regular phone catch up to a review of business performance or setting aside a day to design the future of what your business might look like and map the steps to get there.

We work alongside some pretty incredible people and have cultivated a network of skilled professionals. This means that all questions and issues can be addressed, so you receive the best possible advice and service.

Getting the Basics Right

You are busy and have better things to do than managing taxes and paperwork. So we actively handle every stage to minimise the hassle for you. We take you through every step of the process, from gathering the information to preparing the forms and managing the deadlines throughout the year so that you don't have to.

- We will inform you at the start of each year exactly what your requirements are responsibilities are.

- You will be provided with a fixed fee so that you are not left guessing what your account will be.

- Best of all, you receive unlimited FREE support.

Planning your Future

What plans do you have for tomorrow? Do you intend to retire? Are you going to sell your business or carry on in a reduced capacity?

Thinking about the future feels like a lot of questions and perhaps high levels of uncertainty.

We can turn this around into a structured plan, a clear vision of your future that can be acted upon and achieved. But, let's face it, without a plan, and one more thing becomes uncertain, your future won't be what you dreamed of.

Managing Your Wealth

You work hard. Your efforts may be starting to show up in savings, or you may already have an established portfolio. Either way, you want to make sure that your hard-earned savings are invested tax effectively, protected, and managed professionally.

Happy Tax Australia

07 4755 1111

You pay income tax on assessable income you receive, such as salary and wages, most Centrelink payments, investment income from rent, bank interest or dividends, business income, and capital gains from selling assets like shares or property.

Employment Income

All employment-related income, allowances, payments, and other benefits must be declared on your tax return unless specifically exempted.

Salaries and Wages

Salaries and wages (the main forms of employment income) are payments made under an employment contract as remuneration for services.

Allowances and Other Employment Income

You must declare other types of employment income, such as car allowances and tips.

Lump-Sum Payments

When you leave a job, you may receive lump-sum payments for unused annual and long service leave, which may be taxed concessionally.

Reportable Fringe Benefits and Super Contributions

You also have to show other employment-related items on your tax return, such as reportable fringe benefits and reportable super contributions.

Frequently Asked Questions About Cheap Individual Tax Returns Online Australia

Tax agents and tax professionals usually charge a fee between $100 to $280 on average to fill in and lodge your personal tax return on your behalf.

To lodge online with myTax you will need a myGov account with an active link to the ATO. You can also login to our online service for individuals using the ATO app. The due date to lodge your tax return is 31 October and most refunds issue within 2 weeks. If you need help or support to lodge, check if you are eligible.

In order to submit your taxes, you'll need to furnish the IRS with a lot of informational pieces. They include your name, address, and bank account information where we can deposit any return you may be due. Details regarding your health insurance, including those for your spouse and any dependent children, must also be provided. Provide all of the details regarding your taxable income, including any investment or other supplementary earnings you may have had.

Finding out which costs can be deducted from your taxable income is an important part of the tax filing process. You'll need to submit an itemised accounting of these costs, including dollar amounts, as well as receipts or other documents to back up your claims. If you give us complete and precise information, we can submit your tax return properly and get you any refunds or other benefits to which you are entitled. A tax expert should be consulted whenever there is uncertainty regarding any part of the tax return filing procedure.

Contractors must file CIS tax returns. First, present CIS statements or payslips showing your earnings and contractor tax. These documents can help you calculate your tax liability and pay the right amount of tax on your earnings.

Work-related spending receipts are required along with earnings information. Transportation, equipment, and other job-related expenses are included. By accurately reporting your expenses, you can claim tax deductions and lower your tax bill. If you have questions concerning the CIS tax return process, consult a tax specialist. They can assist you file your return on schedule and with all the relevant information.

The law treats residents and non-residents differently. Australian residents are generally taxed on all of their worldwide income. Non-residents are taxed only on income sourced in Australia. The marginal tax rates are different for income below $45,000, meaning that effective tax rates are higher for non-residents.